TransBnk – AI-ready lending infrastructure for India

Making old banks dance.

TransBnk - Transaction Banking Platform builds API‑led infrastructure that lets banks and corporates create escrow accounts (money is held safely and released only when conditions are met), automate cash flows, and reconcile transactions without manual spreadsheets.

It’s integrated with over 40 banks and serves 220+ clients who hit around 1 500 APIs each month. The company generates revenue through subscriptions and pay‑per‑transaction fees.

On Aug 28, the Mumbai‑based firm closed a ₹2 B (~$25 M) Series B led by Bessemer Venture Partners, with Arkam Ventures, The Fundamentum Partnership, 8i Ventures, Accion Venture Lab, and GMO VenturePartners,Inc. joining.

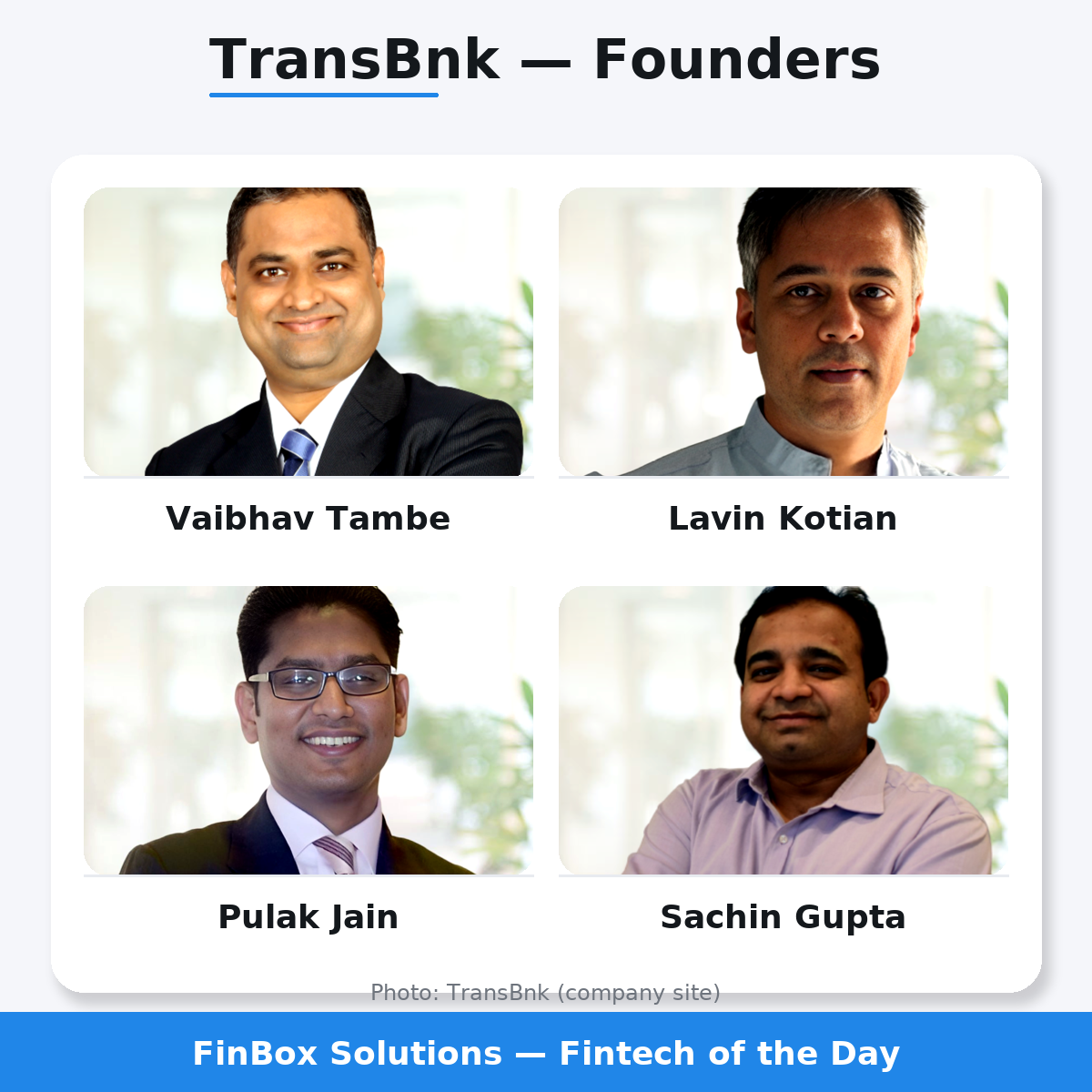

Co‑founders Vaibhav Tambe, Lavin Kotian, Pulak Jain, and Sachin G. launched TransBnk in 2022 and have since built connections to digital lending, supply‑chain finance, and capital‑market services.

Financials (FY 2023–24): revenue ~$335K, net loss ~$156K, lean for banking tech.

When will every bank expose its core as an API?

#fintech #startup #businessmodel #fintechoftheday #banking #API #India

Subscribe for Fintech of the Day. We handpick one fintech startup every day. Please don’t miss the next one and receive emails when new content is published!